The Foundation for the New Economy on Bitcoin

Bitcoin is becoming the next global reserve asset. Reserve assets are productive, not idle SatLayer enables Bitcoin to be productive, programmable, and generate yield by making BTC work through backing/securing insurance, RWA, stablecoin, and AI infrastructure.

TL;DR

- Bitcoin is becoming the next global reserve asset

- Reserve assets are productive, not idle

- SatLayer enables Bitcoin to be productive, programmable, and generate yield

- BTC at work: backing/securing insurance, RWA, stablecoin, and AI infrastructure

Bitcoin is on the verge of becoming the next reserve asset and reshape the global economy, but it still has some work left. SatLayer is laying the foundation to unlock Bitcoin’s potential by transforming it from an idle asset into a productive, programmable, yield-generating collateral. This evolution will redefine the future of finance as we know it.

The Next Global Reserve Asset

To be a global reserve asset is to sit at the foundation of how the world prices risk, stores value, and settles trust. It’s what gold was in the 20th century. It’s what US treasuries once were. And it’s where Bitcoin is headed.The signs are everywhere:

- $145B+ in BTC ETFs pulling in retail capital at scale, the fastest growing ever

- Even more BTC ($379B+) now sits on 180+ corporate balance sheets as a reserve asset: institutions are trading dollars for Bitcoin

- Nation-states and protocol treasuries are also acquiring and holding BTC with conviction

TradFi leaders get it:

- Jerome Powell, U.S. Federal Reserve Chair, publicly called Bitcoin “digital gold”

- Ray Dalio, one of the world’s most influential and successful macro investors, now urges everyone to allocate 15% of their portfolio to BTC

Bitcoin: The Ultimate Convergence between Crypto and TradFi

As Bitcoin cements itself as a global benchmark asset, everyone is recalibrating: corporates are trading dollars for Bitcoin on their balance sheets, governments are evaluating and accumulating it as a hedge against inflation and currency volatility, and fintechs are actively studying how to utilize its massive liquidity and security.

Meanwhile, crypto and TradFi are converging fast: stablecoins moved $27 trillion in volume last year, protocols are tokenising everything from T-bills to real estate, and incumbents Stripe, Robinhood, Bank of America, Visa, and Mastercard are all making major moves.Yet Bitcoin’s limited programmability still keeps most of its $2T+ supply idle. Simply holding BTC will soon mirror stuffing cash under a mattress; activating even 15% of BTC in DeFi (ETH is at 30% and growing) unlocks a $300B+ opportunity in yield and collateral efficiency.

To be a proper global reserve asset, Bitcoin must evolve from passive store-of-value to programmable, productive collateral at the core of the new financial system.

The Rising Benchmark for BTC Yield

When an asset becomes a global reserve asset, people naturally want more of it. The rise of Bitcoin DeFi (aka BTCFi) has pushed BTC yield from <1% into the mid-single digits, attracting growing institutional attention and deployment:

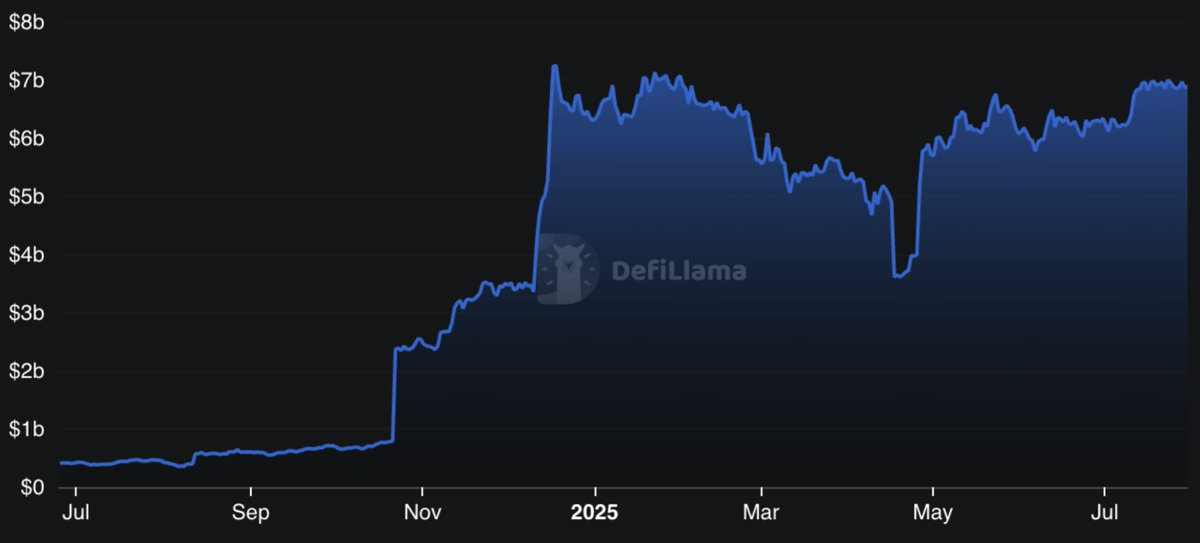

- BTC deployed in staking/restaking have grown 15x in the last 12 months (from $0.4B to $7B)

- Wrapped BTC assets have grown from $12B to $21B+ in the last 6 months

- Yet, less than 2% of BTC is active in DeFi vs. 30% of ETH

The gap between what Bitcoin is and what it can be is still wide.

SatLayer: The Foundation for the New Economy, on Bitcoin

SatLayer is building the economic layer for Bitcoin: Transforming BTC from sitting idle into a productive and programmable asset for DeFi, RWA, stablecoins and even TradFi.SatLayer does this with the core innovation of restaking: fully programmable slashing. Unlike traditional staking implementations where the slashed collateral is burned, SatLayer allows the slashed Bitcoin to be programmatically redistributed.These programmatic rules can be tied to both:

- On-chain conditions, such as smart contract output, bridging and message passing, yield generation

- Off-chain events, such as AI model outputs, real-world data feeds, legal filings

With onchain and offchain based programmable slashing at its core, SatLayer is the link between Bitcoin and the rest of crypto (DeFi, RWA, stablecoins), as well as TradFi (insurance and yield for Bitcoin treasury companies).SatLayer moves fast, from vision to reality within 1 short year.

Achievements include:

- ATH on key metrics

25+ BVS ecosystem partners

$450M+ in TVL

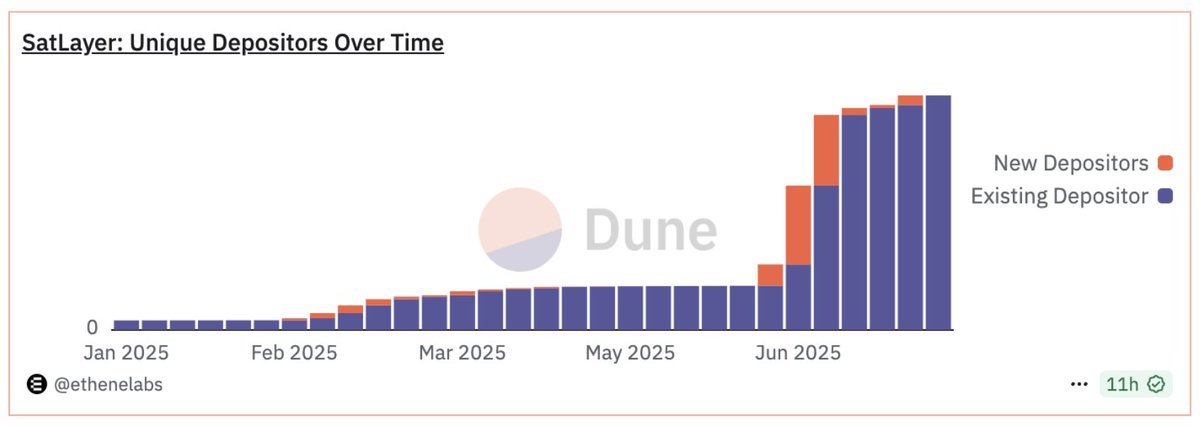

420K+ restakers

1.6M transactions - Exclusive restaking partner of Babylon Labs and only restaking partner of Sui

- Top 5 protocol in Berachain's Boyco by TVL

- Integration with Ethereum, Sui, BOB, TAC, Berachain, BNB Chain and Bitlayer.

- Kaito AI's Yapper Launchpad record holder - first to cross 50M votes, with 54M

- Launched Cube, the first liquid staking protocol for $BABY, Babylon Genesis’s native token

Join us in powering the new financial system:

Key Use Cases: Programmable Bitcoin at Work

SatLayer is working with top protocols across RWA, stablecoins, insurance, and AI, utilizing BTC as productive, programmable collateral - including Plume Network, LayerZero, Cap Money, Nexus Mutual, Relm Insurance, Redstone DeFi, Hyperlane, Avail Project, Primus Labs, Gaib AI, Fiamma Labs, and more.

BTC-Backed Insurance: Bitcoin-shire Hathaway with Nexus Mutual, Relm

In TradFi, insurance is one of the most stable and profitable businesses. Leaders like Berkshire Hathaway, Allianz, and China Life Insurance each manage over $1 trillion in assets.

They can be considered some of the largest investment funds and have a very straightforward model: collect insurance premiums, invest the float (the difference between premiums collected and claim payouts), and generate steady returns of 10% or more.SatLayer enables this, with Bitcoin:

- Instead of USD/fiat-based collateral, Bitcoin is the programmable insurance collateralRestaked BTC is deposited into decentralized insurance vaults

- The real economic yield here comes from the premiums customers pay for coverage

- Claims are paid out using SatLayer’s programmable slashing logic, tied to on-chain or off-chain events

- The system is transparent, automated, auditable, and the yield is accessible to all

Products in development include:

- Principal protected BTC yield, starting with institutions, ETP/ETF issuers, and BTC treasury companies

- BTC-backed reinsurance to limit drawdown of BTC insurance collateral

- Parametric coverage for off-chain events

BTC-Backed/Secured Stablecoins with Cap, Nest Credit by Plume

SatLayer is enabling two distinct but complementary financial primitives with Cap Labs and Plume (Nest Credit) - bringing Bitcoin-backed economic guarantees to stablecoins and on-chain credit.

- Capital-efficient, composable stablecoins secured by BTC - with institutional operators including Franklin Templeton, Apollo Global

- These stablecoins generate yield while maintaining dollar stability, making them ideal for structured credit, on-chain FX, and settlement layers.

- Bitcoin-secured backstop for Nest Credit vaults, where restaked BTC provides instant withdrawal liquidity and principal protection in exchange for yield and premium flows.

Real World Assets (RWA): BTC-Secured Infrastructure

Bitcoin is the original and ultimate RWA/tokenized asset, as Evan of Sui explained during the fireside chat with Luke Xie of SatLayer: great store of value, deeply liquid, more accepted by institutions than any other cryptoSatLayer plugs Bitcoin into the RWA stack - not as passive collateral, but as programmable, enforcement-grade capital. Through integrations with Plume and LayerZero’s Decentralized Verifier Networks (DVNs), BTC now secures RWA issuance, credit events, and settlements.

- BTC restaking powers SkyLink - the modular RWA transfer layer

- Collateral enforcement across tokenized T-bills, corporate credit, and more

BTC-Backed Prime Brokerage for AI infrastructure and RWA

BTC is being used to absorb duration risk, act as margin backstop, and support emerging financial rails:

- Scaling AI infrastructure with [redacted]: BTC enables faster infrastructure loan settlements and better asset management for AI infrastructure providers

- Liquidity float: BTC stabilizes vault strategies on Plume

- Risk buffers for bridging, trading (arbitrage, cross-margin), PayFi, and margin lending systems