A Bitcoin-Secured Backstop for Nest Credit

How SatLayer turns restaked BTC into instant withdrawals and smoother RWA yield

Overview

Plume’s Nest Credit vaults deliver professionally underwritten RWA yield. A small portion of assets (e.g., private credit and other esoterics) naturally settles on longer timelines, which can introduce withdrawal cooldowns during peak activity.

SatLayer overlays a Bitcoin-secured backstop on Nest: when redemptions surge, restaked BTC is posted as collateral to source stablecoins immediately; when the RWA leg settles, the position is unwound and BTC returns to the vault. The effect is bank-style exits without altering how Nest allocates capital.

This integration shows how Bitcoin restakers can underwrite real-world yield products – bringing deep, neutral collateral to RWA liquidity in addition to cross-chain security use cases.

Why this matters

- Great yields, varied settlement: RWA portfolios blend highly liquid instruments (e.g., T-Bills/ETFs) with credit exposures that settle over preset windows. During busy withdrawal periods, relying solely on natural maturities can be inefficient.

- User experience: Savvy users expect redemption times measured in minutes.

- Institutional comfort: A transparent, rules-based capital buffer broadens participation and streamlines operations.

SatLayer addresses timing alignment while keeping Nest’s investment process unchanged.

Why SatLayer?

- Bitcoin-native collateral

- Transform BTC into programmable, slashing-enforced economic security for DeFi/RWA flows—without requiring builders to change stacks.

- Slashing-aligned discipline

- Backstop capital operates under explicit policies (thresholds, LTVs, caps). When conditions fall outside defined windows, pre-agreed penalties apply.

- Operational maturity

- Restaked-BTC vaults, monitoring, and incident playbooks are built for production deployments.

- Builder-friendly

- Plume remains EVM-native; SatLayer manages BTC bonding and Babylon settlement behind the scenes.

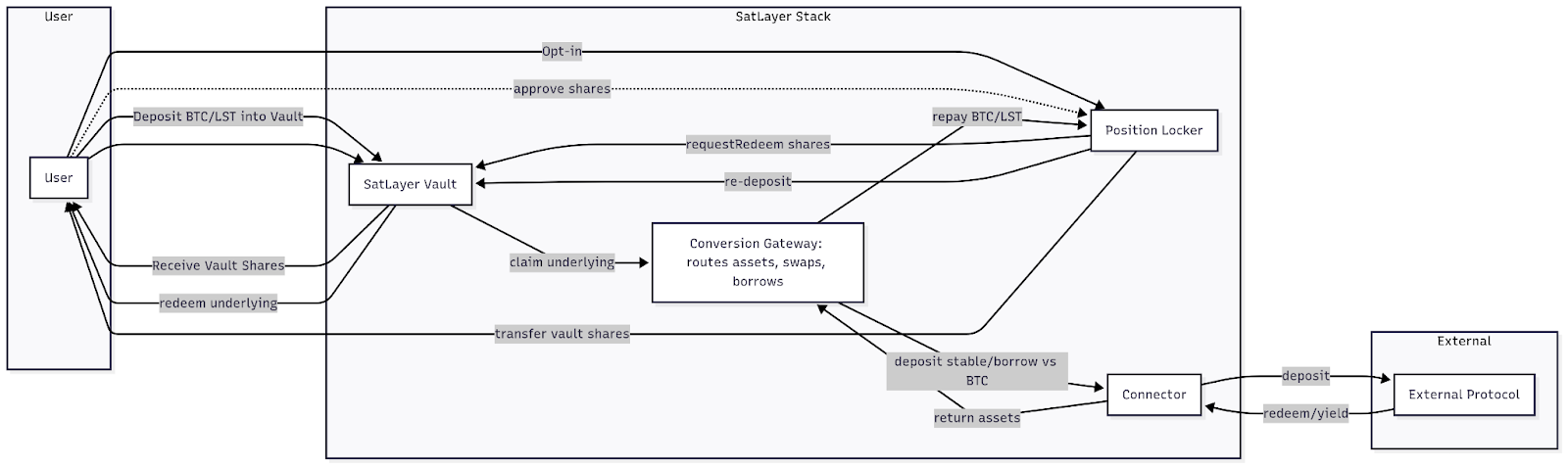

Technical Infrastructure and its roles

- User: User will deposit into SatLayer Vault, then opt-in to the Redemption strategy, which moves vault shares into Position Locker (PL).

- PL (locker/controller): PL will hold user vault shares, enforces caps, opens ERC-7540 request/claim when a redemption is approved, books debtAssets, and later re-deposits when BTC flows back.

- Conversion Gateway (CG) (Executor): CG delivers BTC/ETH/stables, ingests the RWA token into custody (escrow) and unwinds when the RWA is redeemed back to BTC.

- Connectors: there are small adapters:

- Asset Delivery Connectors: It performs swaps and borrows when needed

- RWA Escrow (if needed): It receives the illiquid token, holds it per user, triggers issuer redemption and returns BTC back to CG when settled.

How Bitcoin restakers underwrite real-world yield products via SatLayer and Nest Credits

1. Normal operation

- Users deposit USDC; Nest allocates across liquid (e.g., T-Bills/ETFs) and semi-liquid credit.

- Satlayer restakers: deposit into a SatLayer vault and opt-in to a Nest’sBackstop Strategy.

- Satlayer’s locker contract will track opted-in restakers positions

2. Backstop trigger

When Nest’s liquid buffer dips below an agreed threshold, Nest invokes the backstop:

- Satlayer’s locker contract claims BTC and sends them to the executor contract, which routes them to the appropriate connector.

- The connector supplies BTC to a designated lending market and borrows stablecoins

- Borrowed stablecoins settle withdrawals immediately, eliminating cooldowns.

3. Debt & yield alignment

- The slower-settling RWA slice is assigned as a receivable to the Satlayer’s backstop.

- Its coupons help offset borrowing costs while the position seasons, by flowing into the executor contract, which, in turn, repays and restakes the locker, reducing debt.

- Restakers see debt going down over time as coupons offset borrowing costs.

4. Clean settlement

- At RWA maturity/redemption:

- Redemption proceeds are delivered to the executor contract.

- The executor uses them to repay the lending market, freeing the collateral.

- BTC is then restaked and debt cleared.

- Any residual yield is distributed to the snapshot of restakers active at backstop activation – transparent and fair.

What this unlocks

For Nest users

- Near-instant withdrawals, reduced reliance on discretionary asset sales, and steadier performance.

For Plume

- A visible, rules-based liquidity buffer that elevates TVL potential by welcoming more liquidity-sensitive capital – without re-architecting vaults.

For BTC restakers

- A high-impact role: supporting real-world yield with neutral, deep collateral and earning a premium for doing so.

RWA yield is compelling and timing is central to the experience. With a Bitcoin-secured backstop from SatLayer, Nest Credit adds a dedicated circuit for fast, policy-driven liquidity that aligns with how real-world assets settle. It’s Bitcoin doing what it does best—underwriting value with deep, neutral collateral—applied directly to the redemption experience of modern RWA products.