SatLayer x Babylon: Unlocking the Future of Programmable Bitcoin Security with Restaking

SatLayer is excited to share details of SatLayer’s architecture, which builds on top of Babylon. Babylon is an innovative protocol that enables any Proof of Stake (PoS) blockchain to trust-lessly consume Bitcoin-secured finality.

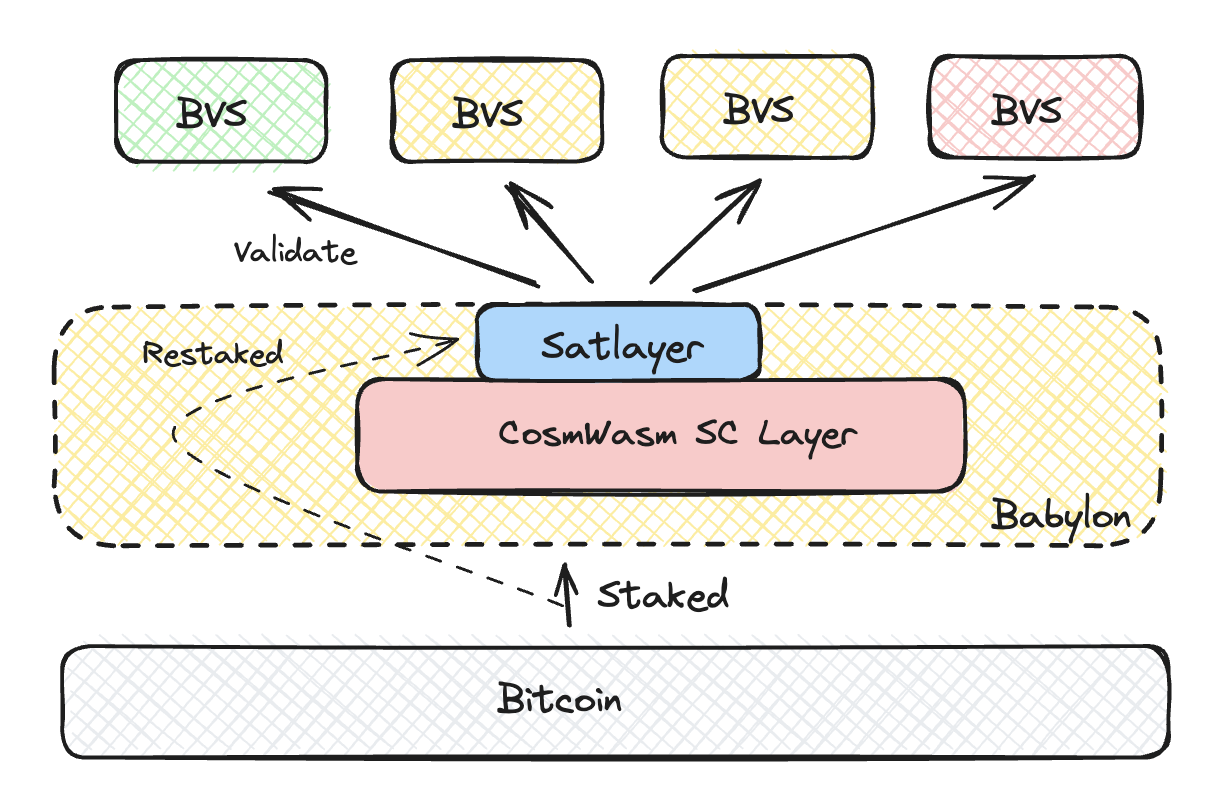

SatLayer brings restaking capabilities to Bitcoin and extends Babylon’s functionality. Bitcoin staked in Babylon can be restaked on SatLayer to provide Bitcoin-backed crypto-economic security guarantees to any protocol or decentralized application, as a Bitcoin Validated Services (BVS).

Today, we’re excited to share details of SatLayer’s architecture, which builds on top of Babylon. Babylon is an innovative protocol that enables any Proof of Stake (PoS) blockchain to trust-lessly consume Bitcoin-secured finality.

“We’re excited about SatLayer’s launch on Babylon and what this means for BTC-secured AVSs,” said Fisher Yu, co-founder of Babylon, “SatLayer will meaningfully expand the Babylon ecosystem, and we’re looking forward to working with SatLayer and their partners to build on Babylon.”

The relationship between Babylon and SatLayer

What is Babylon?

Babylon is a Bitcoin staking protocol and powerful primitive that enables Bitcoin to be used as collateral to secure Proof of Stake (PoS) blockchains against equivocations, aka double signing or double spend, when validators sign two separate blocks at the same block height. Founded in 2022 by Stanford Professor David Tse and Dr. Fisher Yu, Babylon allows for self-custodial Bitcoin staking and yield generation through on-Bitcoin-chain staking script and EOTS cryptographic mechanism that enables the trustless slashing of native Bitcoin in the event of equivocations in the PoS chain.

Bitcoin holders can self generate and lock their bitcoins into a bitcoin staking vault, and use it as slashable stake to secure PoS blockchains which opt-in to consume Babylon security. Only the user holds the secret key to this vault. If this secret is revealed, an external watcher can slash the staked Bitcoin (i.e. send the staked Bitcoin to a predefined address). Bitcoin stakers sign and post block hashes and timestamps to the Babylon Bitcoin Staking Protocol in such a way that their vault secret key can be cryptographically decrypted if they ever attempt to sign two block hashes at the same height for a chain.

In this way, Babylon enables any Bitcoin holder to trustlessly secure any PoS blockchain via the slashable safety mechanism above **(i.e., protection from forking).

SatLayer extends Babylon’s functionality

While Babylon offers Bitcoin-based protection against validators double signing, it cannot extend slashing capabilities to address other forms of misbehavior due to the limitations of the Bitcoin scripting language. Script is not Turing complete, meaning there are limitations to what slashing logic can be implemented.

Currently, decentralized applications (dApps) and protocols seeking to safeguard against issues such as compromised liveness, fairness, correctness, or solvency in more general ways have no means to leverage Bitcoin’s security for these broader challenges.

SatLayer builds on Babylon’s slashable safety guarantees to power its own restaking protocol, which leverages restaked Bitcoin as programmably slashable collateral for security. By doing so, SatLayer significantly broadens the scope of security Bitcoin can offer, unlocking its full potential as a reward-generating asset. (Figure 1).

Examples of BVS use cases to extend Babylon’s functionality

Here are some examples of BVS applications:

- A lending protocol that utilizes restaked collateral as an insurance fund for managing bad liquidations

- A data availability protocol that ensures nodes actually possess the data they claim to store

- A sequencer aiming to guarantee liveness and censorship resistance

- A native Bitcoin DEX that employs restaked collateral for secure trade settlements on the Bitcoin chain

- A Bitcoin-backed stablecoin

- A cross-chain bridge that facilitates seamless interoperability between Bitcoin L2s/sidechains and other L1 ecosystems

… among others!

Various existing categories of dApps and protocols—such as rollups, data availability layers, oracles, lending protocols, automated market makers (AMMs), and perpetual DEXes—can be restructured to be secured by Bitcoin collateral.

This approach enables such applications to easily leverage Bitcoin-backed crypto-economic security guarantees and solves the cold start problem of relying on a protocol’s own utility token for foundational security.

What is SatLayer?

In order for dApps and protocols to consume Bitcoin collateral for security in a generalizable and robust way, developers must be able to specify arbitrary slashing conditions for operator misbehavior.

SatLayer extends Babylon to enable programmable slashing of Bitcoin by allowing developers to register such slashing conditions in smart contracts deployed on top of SatLayer’s Babylon-secured service. More specifically, the on-chain component of the SatLayer protocol will be deployed to Babylon’s CosmWasm smart contract chain, a Turing-complete execution layer whose finality is secured by Babylon (and thus is itself secured by staked Bitcoin).

The on-chain component allows:

- Restakers to stake Bitcoin collateral and delegate to Operators

- BVSes to specify slashing and settlement conditions

- Operators to register to and perform work on BVSes using their delegated collateral

- Independent slashers to prove when such violations have taken place

All of these activities settle on top of the Babylon-secured CosmWasm smart contract layer, and thus inherits security from the Bitcoin staked to secure this layer.

As long as the cost of corruption of any individual BVS is less than the cost of corrupting (i.e., successfully forking) the smart contract layer, the security assumption for each BVS is roughly proportional to the Bitcoin restaked to secure it. This means that SatLayer introduces no extra crypto-economic security assumptions relative to the BVS itself, Bitcoin, and Babylon!

SatLayer’s ecosystem participants

The SatLayer ecosystem is comprised of the four major types of participants listed above: restakers, operators, BVSes, and slashers.

Here, we illustrate the different participants along with some examples as well as expanding on their respective functions below (Figure 2).

Restakers: These participants stake Bitcoin collateral into SatLayer’s smart contracts (which are deployed on top of Babylon’s smart contract chain). They can also choose to delegate this stake to an operator. This Bitcoin collateral can come in multiple forms such as:

- (i) a Babylon Liquid Staked Token (LST) representing Bitcoin which has been staked in the Babylon protocol on behalf of the user by an LST protocol. The LST could then earn restaking yield from SatLayer on top of Babylon staked yield. There are several Babylon LST protocols to choose from including Solv, Lombard, uniBTC, Lorenzo, pStake, and pumpBTC (among others)

- (ii) Tokenized Bitcoin equivalents which have been bridged into the Babylon ecosystem. These can include wrapped Bitcoin held by custodians such as WBTC or FBTC, or Bitcoin staked or otherwise tokenized by Bitcoin L2s and sidechains. Some of these could also be yield bearing - restaking into SatLayer will enable holders to earn restaking yield in addition to the token’s own endogenous yield.These tokens will be bridged in using either the token protocols’ own internal interoperability mechanism or using SatLayer’s Bridge BVS. The Bridge BVS, secured by the SatLayer protocol, creates an interesting flywheel by becoming more trustworthy as more collateral is bridged in and restaked to secure it. Stay tuned for more details here! 👀

Operators: Node operators choose a set of Bitcoin Validated Services (BVSes) to validate, perform the necessary work, and receive payments from BVSes in return for performing validation work honestly. These payments are then passed on to Bitcoin restakers, generating yield. The operator’s goal is to select a set of BVSes to validate which maximizes their yield on delegated capital and minimizes their operating costs and slashing risk.

Bitcoin Validated Services (BVSes): BVSes are protocols and decentralized applications which wish to use Bitcoin as collateral to augment the cryptoeconomic security properties of their application. When registering their BVS into SatLayer, developers specify on-chain the conditions under which operators are slashed and also stream payments to operators according to off-chain calculations.

Slashers: These entities act as watchdogs and trigger slashing events onchain (along with the associated proofs) when operator misbehavior is detected.

Conclusion

This article presents an overview of SatLayer’s architecture.

Stay tuned for details on the SatLayer system architecture and the unique use cases SatLayer is unlocking!

In our next article, we’ll dive into the types of BVSes that could be built on SatLayer and how consuming restaked Bitcoin security makes the Bitcoin ecosystem more secure, robust, and censorship resistant.

If you’re interested in earning some rewards on your Bitcoin or participating in the SatLayer ecosystem, check out our early depositor program. Depositing into this program earns you Sats², which is a measure of your contribution to the success of the SatLayer ecosystem.

Follow SatLayer

Keep up to date with developments on our journey to Mainnet 🫡